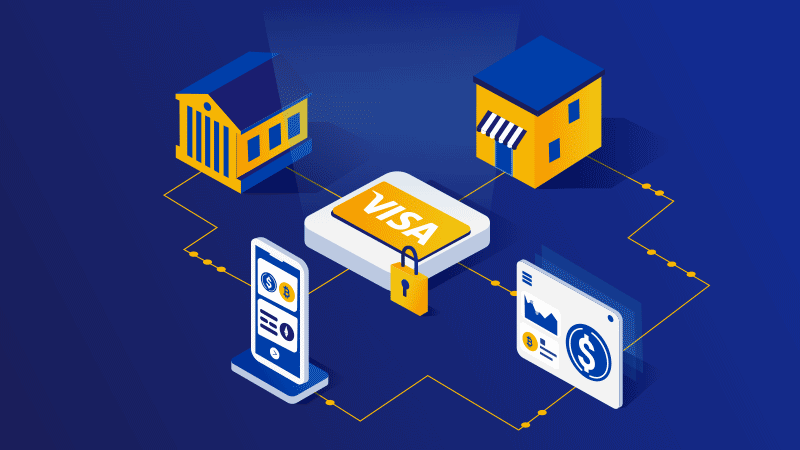

Visa, an electronic funds facilitator best known for it’s visa-branded debit and credit cards, has announced that it plans to settle transactions using Ethereum’s public blockchain and USDC, a cryptocurrency stable coin (ERC20 token built on Ethereum). Visa announced on Monday that it just launched a pilot program for the move, and plans to integrate with additional parties throughout the year.

We believe that digital currencies have the potential to extend the value of digital payments to a greater number of people and places. As such, we want to help shape and support the role they play in the future of money. We look forward to sharing more with you on this work in the months that follow.

Visa partnered with cryptocurrency payment platform crypto.com and Anchorage to launch the program. The payment processor first detailed it’s some of it’s cryptocurrency plans back in July of 2020 in a blog post titled “Advancing our approach to digital currency“, where it stated that it began working closely with licensed and regulated cryptocurrency exchanges and organizations such as Coinbase & Fold to expand it’s reach. At the time Visa claimed that over 25 different cryptocurrencies’ wallets have linked services with Visa to allow it’s users to spend cryptocurrency using a Visa debit or pre-paid card anywhere that accepts it.

“As a global payments technology company, Visa is focused on delivering the greatest value to people, businesses and economies everywhere, regardless of currency, channel or form factor. We’re reshaping how money moves across the globe, and that means pursuing a broad array of technologies and partnerships. In that regard, digital currencies offer an exciting avenue for us to continue doing what we do best: expanding our network-of-networks to support new forms of commerce.”

According to last year’s publication Visa has also outlined it’s strategy in the move,

- Security, privacy, integrity and trust. We will maintain a rigorous focus on data protection, consumer privacy and fairness, and full compliance with all applicable laws.

- Remaining currency- and network-agnostic: We plan to support the digital currencies and blockchain networks that our clients and partners demand, in keeping with our broader network-of-networks strategy.

- Alignment with Visa’s core capabilities: We have deep expertise in securing transaction data, working with diverse stakeholders, and maintaining an always-on network with continuous availability. We will pursue projects that allow us to apply this expertise to new networks and technologies that can benefit our existing clients and partners.

Anchorage, a cryptocurrency bank of sorts has positioned itself as Visa’s USDC settlement agent.

“Visa came to us in 2019 with an idea—make secure, efficient, and seamless settlement payments possible in digital currency by linking Visa’s treasury with Anchorage’s custody platform, this would give the next generation of crypto native issuers the option to directly settle with Visa in a digital currency over a public blockchain.” – Diogo Mónica, President of Anchorage

The trio (Visa, Crypto.com, Anchorage) have already settled their first transaction which marked the start of the program, which they expect to run throughout the year to ensure stability and security before further expanding. The transaction settlements will occur over Ethereum’s public blockchain using USDC.

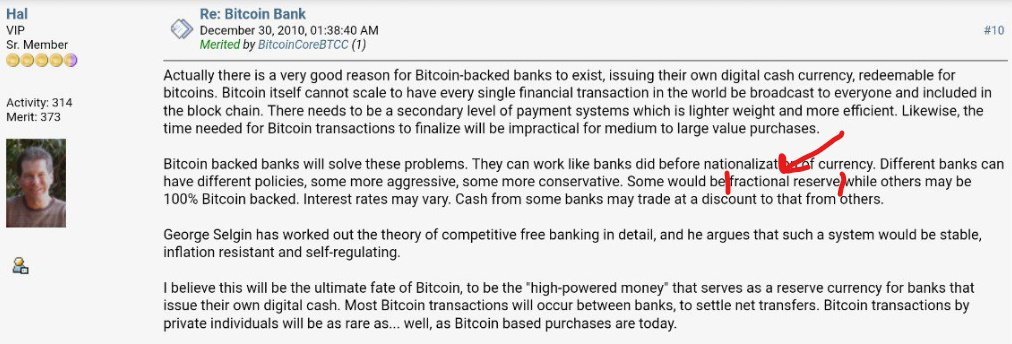

While some may question cryptocurrency’s direction and integration with banks, others such as Bitcoin contributor Hal Finney saw this coming with impeccable foresight, case in point Finney’s comments on the bitcointalk forum over a decade ago –

Actually there is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, redeemable for bitcoins. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient. Likewise, the time needed for Bitcoin transactions to finalize will be impractical for medium to large value purchases.

Bitcoin backed banks will solve these problems. They can work like banks did before nationalization of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others.

George Selgin has worked out the theory of competitive free banking in detail, and he argues that such a system would be stable, inflation resistant and self-regulating.

I believe this will be the ultimate fate of Bitcoin, to be the “high-powered money” that serves as a reserve currency for banks that issue their own digital cash. Most Bitcoin transactions will occur between banks, to settle net transfers. Bitcoin transactions by private individuals will be as rare as… well, as Bitcoin based purchases are today.

https://bitcointalk.org/index.php?topic=2500.0

Perhaps a testament to cryptocurrency’s massive growth and adoption. Here at Xitheon we also recently decided to accept USDC payments in exchange for VPS servers & web hosting services for much of the same reasons outlined by Visa, and we expect many more companies and organizations to follow suit in the near future.

The future is here, are you?